Diving Deep into the Bitcoin Rabbit Hole at Baltic Honeybadger 2022

The Baltic Honeybadger 2022 Bitcoin conference took part 3-4 September in Riga, Latvia. The event, previously held pre-covid in 2019, is a gem in the Bitcoin conference circuit due to its small size, fantastic location, and world-class speaker line-up. It may well be the Bitcoin event with the most signal and the least noise.

Day one’s highlights included a talk by Jimmy Song, one of the longest-active Bitcoin educators, about the necessity of making Bitcoin an alternative to the current debt-fueled fiat system. The provocative presentation was called “Fiat Delenda Est,” in English, “Fiat Must Be Destroyed,” inspired by the ancient rivalry between Rome and Carthage. Mr. Song raised freedom, building, and truth as the three pillars that will make a Bitcoin-backed world economy fairer and more inclusive.

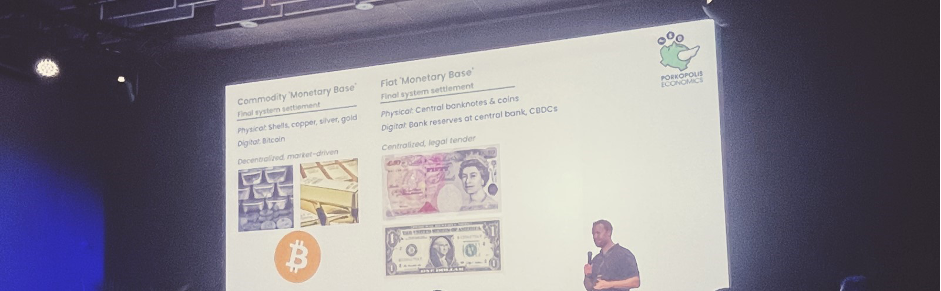

Matthew Mezinskis’ presentation on Gold, Bitcoin, and CBDCs (Central Bank Digital Currencies) highlighted the counter-intuitive fact that while cash is disappearing altogether from the daily lives of many of us, the amount of physical money continues growing incredibly fast, doubling every seven years.

The rising popularity of physical cash means that CBDCs will meet a double challenge in gaining adoption, especially in less authoritarian countries: First, central banks need to reconcile the fact that commercial banks have little interest in handing over their direct consumer relationship to central bankers, and second, people using physical cash are unlikely to want to replace it with perpetual digital panopticons in the form of CBDCs. It will be interesting to see how things play out in the coming years.

The founder of the payment startup Strike, Jack Mallers, educated the audience via a video call about the mechanics of the credit card business and highlighted the many benefits of using Bitcoin’s Lightning Network as the rails for instant and close-to-free fiat-to-fiat payments. You can find an overview of how Strike operates here.

In short, it provides a Mobile Pay-like experience in which people can send dollars to other Strike users or participating merchants, with the caveat that “under the hood,” the money moves as Bitcoin via the Lightning Network 2nd layer infrastructure. As a more legacy world-adjacent startup, it will be fascinating to see how people and businesses will adopt their innovative approach worldwide.

Highlights from day two of the conference included a talk by Desiree Dickerson from THNDR Games on “Bringing Bitcoin to the World through Play.” She leads a groundbreaking game company that creates mobile games where players can earn tiny amounts of Bitcoin, called satoshis or sats, by playing.

According to Ms. Dickerson, 60% of gaming is mobile, and women between the ages of 35 and 50 are one of the fastest-growing demographics. THNDR Games’ thesis is that if their games gain mass adoption, they can introduce millions of new people, especially women in developing countries, to Bitcoin through fun gameplay. As an occasional gamer and full-time bitcoiner myself, I hope they succeed in their mission.

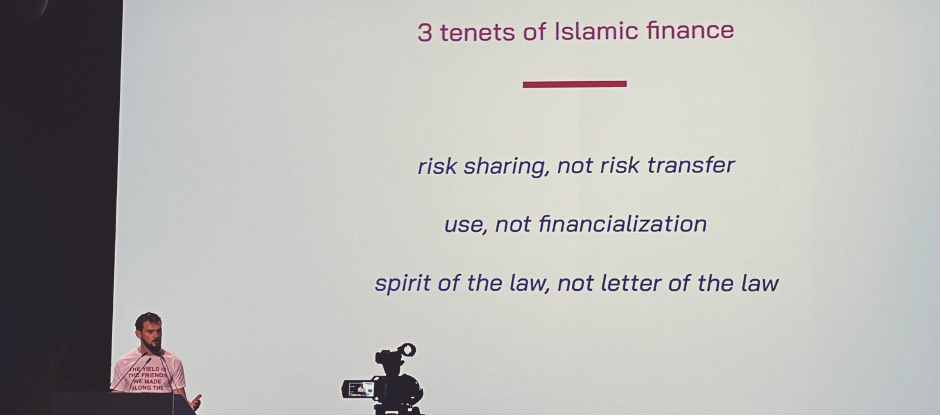

The author and venture capitalist Allen Farrington spoke about “Bitcoin and Islamic Finance,” introducing thought-provoking concepts, such as the questionable morality of debt-based economies prevalent in the so-called west. Mr. Farrington’s thesis relies heavily on the fact that Bitcoin is a digital bearer instrument outside financial institutions’ influence. On the contrary, the world economic system relies heavily on debt instruments, which leads to cascading credit crises every 10-15 years. This thorough Medium article explains Mr. Farrington’s thoughts in more detail.

The closing panel, “Unpopular opinion,” was hosted by the popular podcaster, thinker, and entrepreneur Marty Bent. It featured the Bitcoin educator Giacomo Zucco, researcher Paul Sztorc, and Bitcoin core developers Peter Todd and Eric Voskuil.

The discussion included entertaining disagreements about the rationale for so-called tail emissions. It refers to the idea of adding a fixed block reward after Bitcoin reaches its final 21 million mined coins in around 2140. The 21 million hard cap is one of the rigorously guarded principles of Bitcoin, so Mr. Todd’s ideas faced fierce opposition from other panelists.

Mr. Sztorc represented another unpopular opinion about the virtues of sidechains for the Bitcoin network. He argues that sidechains would bring optional hard forks, the possibility to upgrade Bitcoin in stages, and rally the so-called blockchain community to build upon Bitcoin instead of their projects. Unsurprisingly, most audience and panel participants felt that sidechains are not the best way to add new features to Bitcoin.

Second-layer technologies, such as the Lightning Network, are already inspiring many talented entrepreneurs to build innovative features on top of the Bitcoin base layer. One such founder is the CEO of Fedi, Obi Nwosu, whose company seeks to bring “community-style” collaborative custody and circular economy solutions to Bitcoin.

In short, the idea is that a group of people can designate a small number of its most Bitcoin-savvy members to take care of securing the group’s bitcoin. Everyone else can then get so-called Chaumian e-cash tokens that they can use in local circular economies. The innovation of the e-cash tech mentioned above is that even the custodians of the group’s bitcoin cannot see the transactions and balances people make with the e-cash tokens.

The most potential markets for Fedi, and the underlying open-source technology Fedimint, are developing economies of Africa, Asia, and South America. If it succeeds, Fedimint can bring financial independence to millions who need it the most.

In between the great presentations, I had the chance to talk with many people about Oivan’s Hatch white-label Bitcoin savings app, which allows legacy financial institutions to launch their own Bitcoin service for a fraction of the time it would take to self-develop.

Aside from the high signal conference program, the social vibe of the Baltic Honeybadger was in a league of its own. Every other bar in the beautiful old town was teaming with bitcoiners getting to know each other and exchanging thoughts, often until closing.

For anyone interested in diving into the deep end of Bitcoin culture, the Baltic Honeybadger conference offers an unparalleled experience. The location, speakers, focus, size, audience, and vibe make it a one-of-a-kind event in the Bitcoin scene.

Are you interested to know more about our Blockchain service? Contact Oivan CEO Rami Korhonen at rami.korhonen@oivan.com | +358407307813 for more information.