Oivan Announces White-Label Bitcoin Savings App Hatch

Winters in Finland are long and dark, so some of our experienced team members had time to work on an internal, Bitcoin-related design and coding project in-between client work in the past six months.

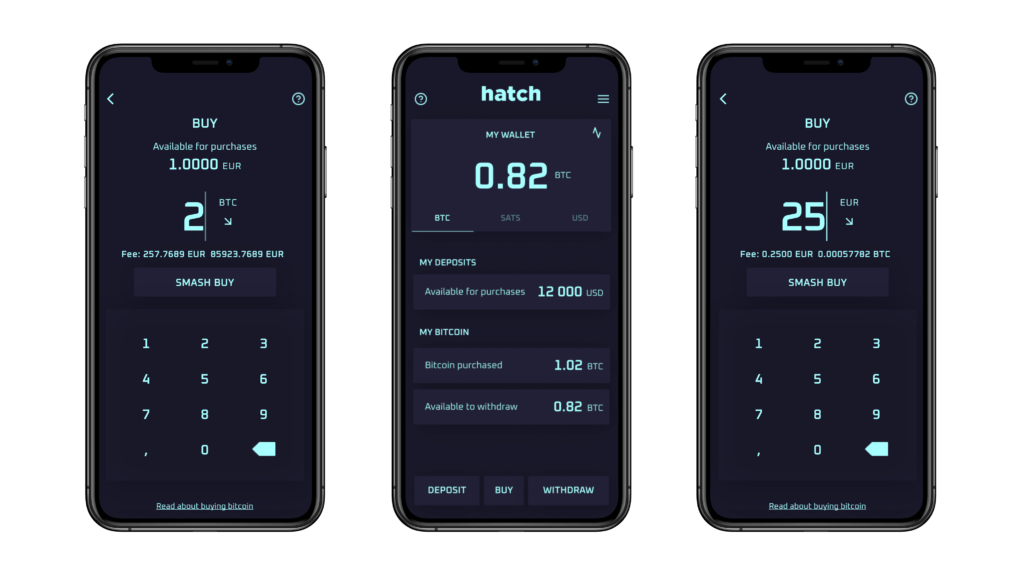

We came up with Hatch, a modular and easily customizable white-label app for buying and saving Bitcoin, targeted at legacy businesses wanting to add Bitcoin saving as a new feature in their service portfolio.

Our background in building Bitcoin services started in 2013 when our team developed and launched a complete Bitcoin buying/storing service that is still going strong in Europe over the years; our team has continuously been involved with deep technical development.

In practice, we have built a complete Bitcoin buying/storing service from scratch two times before creating Hatch.

Hatch is now ready to be implemented for clients who want to add a highly secure, reliable, and well-designed Bitcoin section in their existing app or launch a stand-alone Bitcoin savings service.

What do We Mean by Bitcoin Saving?

At Oivan, we make a clear distinction between Bitcoin and crypto. The speculative world of cryptos consists of thousands of projects, many of them frauds, well-intentioned startups with unproven solutions, or digital replicas of the legacy world’s rigged systems.

Bitcoin is arguably the only blockchain invention that has found an irreversible product-market fit. It is leaderless, censorship-resistant, decentralized, launched without pre-mining, and has a credibly hard-capped monetary supply of 21 million bitcoin. Well over 100 million people are already using Bitcoin, and that number will likely double in 2022.

It has been working for years precisely as planned, allowing people to send value across time and space and store their wealth securely. It works the same way for a Ukrainian aid worker receiving bitcoin donations from abroad as it does for Tesla in protecting their balance sheet from the depreciating buying power of US dollars.

Up to this day, everyone who has bought and held bitcoin for over four years has increased their relative buying power for goods and services. As an ascending monetary commodity, the world is trying to assess Bitcoin’s value in real-time, which has led to the famous volatility in bitcoin’s price in the short term. Still, the trend is up and to the right when zooming out.

Easy Access to Bitcoin savings

We believe that any bank that today offers stock market investing within their banking app should seriously consider adding a new section in their app for Bitcoin saving.

From the end-user’s perspective, the service is seamless to use. The user has already completed KYC/AML when signing up to the existing banking app, so moving to the Bitcoin savings section could happen with one click.

Once in the Bitcoin section, the user can deposit local currency from their bank account into the Bitcoin app, choose the amount to buy, purchase bitcoin, and either store it in the app or transfer it to her self-custody wallet.

Aside from the white-label technology, Hatch also includes a wide range of educational content, emphasizing how to safely self-custody your bitcoin.

The neobank Revolut is a 3rd party example of an existing service with a similar experience but without the option for self-custody for most users. With Hatch by Oivan, any bank can launch Revolut-like Bitcoin savings feature without building it from scratch.

Oivan Has Long Experience of Bitcoin and Blockchain Technologies

Oivan is a 200+ expert IT consultancy that creates and runs national e-services and has worked with several large banks internationally. So, when working with us, banks and financial institutions get the professionalism, support, and quality they expect.

We understand that Bitcoin is a somewhat tricky topic for most banks and financial institutions. The well-documented frauds of the crypto market, bitcoin’s early use cases in criminal activity, negative narratives on Bitcoin’s energy use, and regulatory pressures make sitting on the sidelines the safest option for most banking professionals.

However, our thesis is that Bitcoin’s influence will gradually seep into almost every financial activity. We already have Bitcoin as legal tender in a country, an S&P500 company holding Bitcoin as their reserve asset, future-oriented banks offering Bitcoin services, the list goes on.

So far, patient long-term Bitcoin saving has yielded positive results, and it’s likely it will also happen in the future. Furthermore, simple bitcoin ownership (also known as HODLing) is the use-case least scrutinized by regulators worldwide.

Unlike the majority of blockchain projects, Bitcoin is not a fraud or an unproven experiment. It is a rapidly growing digital monetary network that millions of people already use. To echo Bitcoin’s anonymous creator Satoshi Nakamoto, for banks and financial service providers, “it might make sense to launch your Bitcoin savings app in case it catches on.”

Open Source Plans & Meet Me At Bitcoin 2022 in Miami 6-9 April

I will be at the Bitcoin 2022 conference in Miami, USA, on April 6-9. If you are there, I am happy to meet and discuss. We are always excited to talk about digital transformation, cybersecurity, and opportunities around Bitcoin for businesses. If you cannot make it to Miami, you can reach me at rami.korhonen@oivan.com | +358407307813.